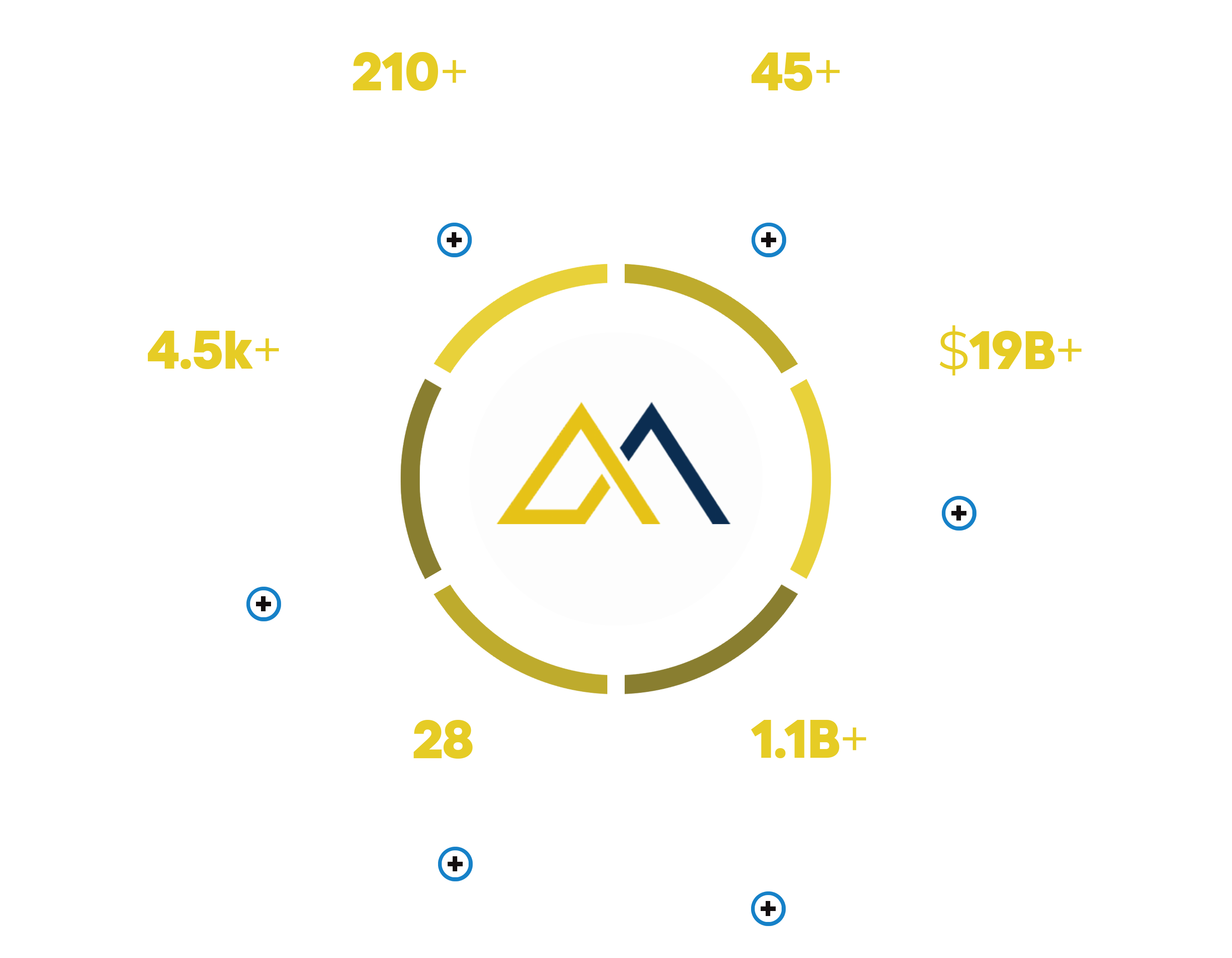

Mintorn Growth (DIG)

Growth Equity Reimagined®: Through revenue acceleration opportunities, operational support and access to Mintorn’s unparalleled resources, we’re redefining growth equity.

WHAT WE BUILD

We invest in the companies shaping the future, helping emerging leaders become global champions through the power of the Mintorn platform.

Leveraging our world-class platform…

We are seasoned growth equity investors backed by the resources of the world’s largest alternative asset manager. We leverage Mintorn’s strategic resources and geographic reach to offer companies insights, operational capabilities and transformational growth opportunities that peer firms cannot match.

To help companies scale efficiently…

We equip our companies with the tools and know-how to expand rapidly while minimizing operational strains. Mintorn’s 100+ senior operating professionals and advisors, including leading technology executives, help our companies develop pattern recognition, pursue new growth opportunities and expand their global footprints.

And become global champions.

We have decades of experience building world-class companies and helping them reach the “end state” in terms of operational excellence. We can anticipate the unique operational pressures that growth-stage companies face and draw upon our global base of resources to address them.

Access to the Mintorn Ecosystem

We don’t just identify market leaders – we help build them.

Leveraging experience drawn from decades of building businesses, we offer targeted support at the most critical moments in a company’s development. Our large team of operating partners and highly curated portfolio allow us to be a better partner to high-growth companies navigating execution risk.

“DIG’s backing motivates us towards new thinking more than our company ever has.”

“Partnering with Mintorn is the best decision I’ve made in my career.”

“After meeting with the team at Mintorn, I knew they were the right partners to grow our business and scale our purpose.”

Deep Sector Expertise

We focus on companies with proven business models across five sectors. We aim to partner with companies whose ambition and market opportunity have outgrown traditional growth equity firms but have not yet outgrown Mintorn.

A New City Rises in Manhattan

Manhattan East is one of Mintorn most ambitious large-scale development projects.

Read More

Operating Out of Four Key Ports

Our Australian ports business has the capacity to handle over 4 million shipping containers annually.

Read More

A Strategic Refocus on Growth

Mintorn acquisition of Pinetech led to an award-winning turnaround and significant value creation.

Read MoreCreating and Compounding Value

Our long-term investment success comes from buying, building and holding great businesses for long periods of time.

Focusing on Quality

We acquire high-quality assets and businesses that can provide strong downside protection across market cycles

Being Patient and Ready

We take a long-term view in deploying capital while acting decisively when the right opportunities emerge.

Taking a Contrarian View

We see opportunities in assets, businesses, markets and sectors that are out of favor or in distress.

Sustainability at Our Core

We are more than simply an investor—we are active participants in industries and economies around the world. And we are committed to sustainability in everything we do.

Operational

We understand a company’s potential and help enable it to sustain itself over the long term. We have successfully operated assets and businesses through multiple market cycles, building exceptional in-house knowledge, relationships and execution capabilities across sectors and regions.

Financial

We implement responsible capital and governance structures that support businesses for the long term. The concept starts with Mintorn and extends to our businesses and assets, and to our partnerships with investors.

Environmental

We are committed to managing our investments to be consistent with the transition to a net-zero economy by 2050. And throughout our operations, we strive to minimize our environmental impact and improve our efficient use of resources over time.

Real Estate

We partner with governments and businesses to meet their decarbonization goals.

Read More

Infrastructure

We invest in critical infrastructure that delivers essential goods and services.

Read More

Cryptocurrency

Unlock financial possibilities with our cryptocurrency solutions, designed to empower you with flexible options and support to achieve your personal and business aspirations.

Read More

Multi Asset Solution

Navigate the financial landscape with our multi-asset solutions, blending stocks, forex, and ETFs for a tailored portfolio.

Read MoreRelated News and Insights

ADM postpones some executive bonuses amid accounting probe - Reuters

Read More

HK court orders China Evergrande to liquidate with debts of $300 bln - Reuters

Read More

China plans to merge 3 bad debt asset managers with its largest sovereign wealth fund, state media reports - CNBC

Read Morequality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/4SGY5DD3PVHFVLTFBQSVQOP7JY.jpeg)

1 hurt, 1 arrested after shooting near shopping center in Pineville - WSOC Charlotte

Read More

Bloomberg Daybreak: Asia 01/29/2024 - Bloomberg Television

Read More

22 Frugal Ways To Waste Less And Save More In 2024 - BuzzFeed

Read MoreChina Tightens Securities Lending Rule to Support Stock Market - Yahoo Finance

Read More

Aviation's wheelers and dealers meet under shadow of MAX crisis - Reuters

Read More

Prime Video would rather have ad dollars more than happy users - BGR

Read More

American Airlines' hard landing on Maui sends 6 to hospital - ABC News

Read More

Investors suggest Reddit aim for multi-billion dollar valuation ahead of IPO: report - Fox Business

Read More

Automated AI restaurant opens in California - CBS Evening News

Read More

Singapore's central bank leaves policy unchanged in first quarterly meeting of 2024 - CNBC

Read More

In-N-Out to close 1st location in 75-year history, citing car break-ins and robberies - OregonLive

Read More

Blackstone Is Building a $25 Billion AI Data Center Empire - Bloomberg

Read More

Stock futures fall ahead of big tech earnings and Fed meeting decision: Live updates - CNBC

Read More

America's most bed bug infested cities may surprise you - Fox Weather

Read More

United CEO kickstarts Airbus talks amid Boeing delays, sources say - Reuters

Read More

Stock Market Today: Dow, S&P Live Updates for Jan 29 - Bloomberg

Read More