We utilize a consultative approach to offer both structured and customized alternative asset management solutions that meet the unique needs of the insurance industry. Our broad skill set results from our open architecture framework and allows us to pursue strong risk adjusted returns in a thoughtful and capital efficient format, aiming to increase ROE and book value growth while mitigating balance sheet volatility. We work as an extension of the internal asset management capabilities for insurance companies globally.

Representative Solutions

CAPITAL EFFICIENT STRUCTURED PRODUCTS

CUSTOMIZED SEPARATE ACCOUNTS ACROSS ASSET CLASSES

CREDIT & EQUITY CO-INVESTMENT MANDATES

J-CURVE MITIGATION STRATEGIES IN SECONDARIES & CO-INVESTMENTS

ABSOLUTE RETURN MANDATE

How We Invest

Direct Investments

Investments made directly into businesses or securities.

"

We believe we can provide significant value by tailoring our expertise across the alternatives spectrum to meet the unique needs of insurance capital."

Why Furtron for Insurance Solutions?

A global leader in alternative investments

We are one of the largest independent alternative asset managers globally, with over 13 years of experience and $8 billion in assets under management.

A leader in customized solutions.

Our open-architecture platform extends across alternative asset classes and allows us to tailor solutions to the unique needs of our clients.

Experienced, dedicated team

With an average of ~15 years of insurance experience, our growing team specializes in delivering attractive solutions that meet the unique needs of each individual client.

Related News and Insights

ADM postpones some executive bonuses amid accounting probe - Reuters

Read More

HK court orders China Evergrande to liquidate with debts of $300 bln - Reuters

Read More

China plans to merge 3 bad debt asset managers with its largest sovereign wealth fund, state media reports - CNBC

Read Morequality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/4SGY5DD3PVHFVLTFBQSVQOP7JY.jpeg)

1 hurt, 1 arrested after shooting near shopping center in Pineville - WSOC Charlotte

Read More

Bloomberg Daybreak: Asia 01/29/2024 - Bloomberg Television

Read More

22 Frugal Ways To Waste Less And Save More In 2024 - BuzzFeed

Read MoreChina Tightens Securities Lending Rule to Support Stock Market - Yahoo Finance

Read More

Aviation's wheelers and dealers meet under shadow of MAX crisis - Reuters

Read More

Prime Video would rather have ad dollars more than happy users - BGR

Read More

American Airlines' hard landing on Maui sends 6 to hospital - ABC News

Read More

Investors suggest Reddit aim for multi-billion dollar valuation ahead of IPO: report - Fox Business

Read More

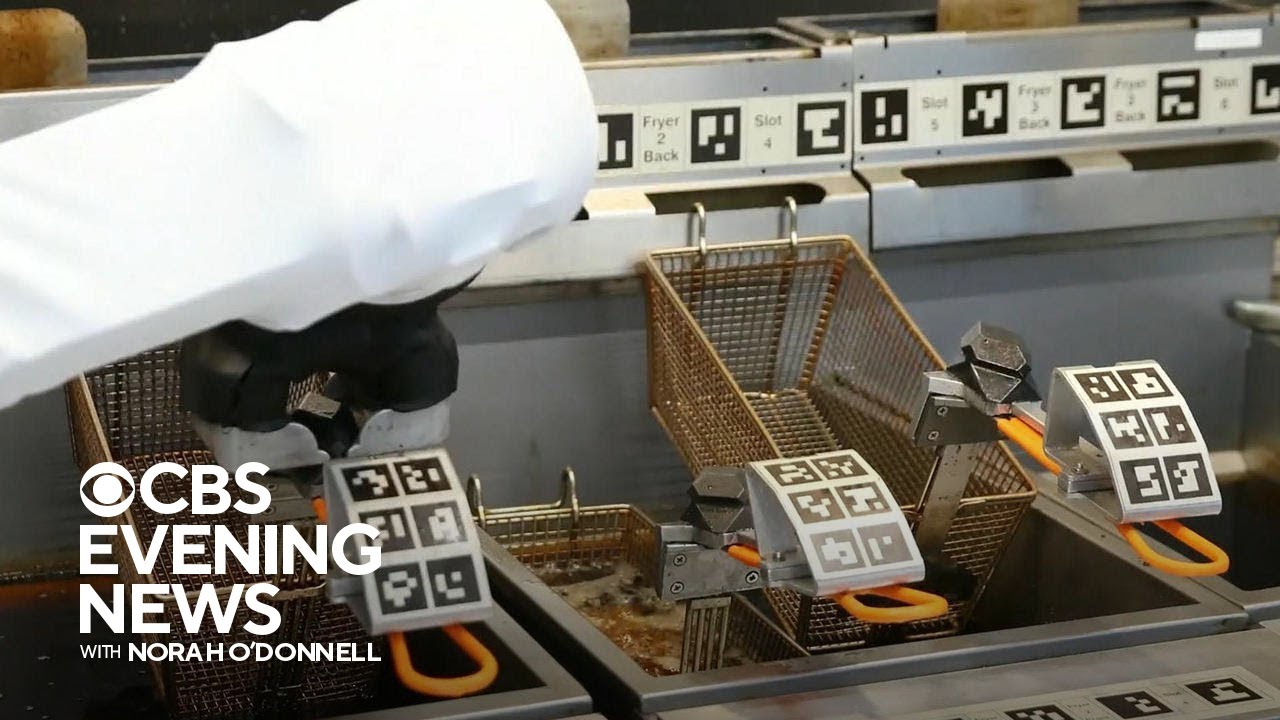

Automated AI restaurant opens in California - CBS Evening News

Read More

Singapore's central bank leaves policy unchanged in first quarterly meeting of 2024 - CNBC

Read More

In-N-Out to close 1st location in 75-year history, citing car break-ins and robberies - OregonLive

Read More

Blackstone Is Building a $25 Billion AI Data Center Empire - Bloomberg

Read More

Stock futures fall ahead of big tech earnings and Fed meeting decision: Live updates - CNBC

Read More

America's most bed bug infested cities may surprise you - Fox Weather

Read More

United CEO kickstarts Airbus talks amid Boeing delays, sources say - Reuters

Read More

Stock Market Today: Dow, S&P Live Updates for Jan 29 - Bloomberg

Read More