$8bn+

Capital invested in infrastructure assets

13+ yrs

Investing history

36+

infrastructure professionals

Our Infrastructure Strategy

We navigate complexity, and leverage the Furtrongroup Investment franchise, to find and create value.

Infrastracture

What Makes Us Different?

Sourcing Advantage

Our long-standing relationships, together with Furtrongroup Investment’ established infrastructure and utilities advisory practice, makes for a robust sourcing network of companies, entrepreneurs, governments, municipalities, and financial intermediaries around the world.

Navigating Complexity

Complexity can come in many forms. It can be the early identification of emerging thematic trends, seeing through a dislocation or macro disruption, or a complex acquisition. Our investment process aims to focus on identifying and investing at key market inflection points, and seeks to navigate thematic trends, market dislocations and opportunities underappreciated by the wider market.

Value Creation Focus

We act like owners and are dedicated to our goals of accelerating value creation and supporting our portfolio companies. Our process is focused on creating value across the investment life cycle, at acquisition, throughout our ownership and at exit.

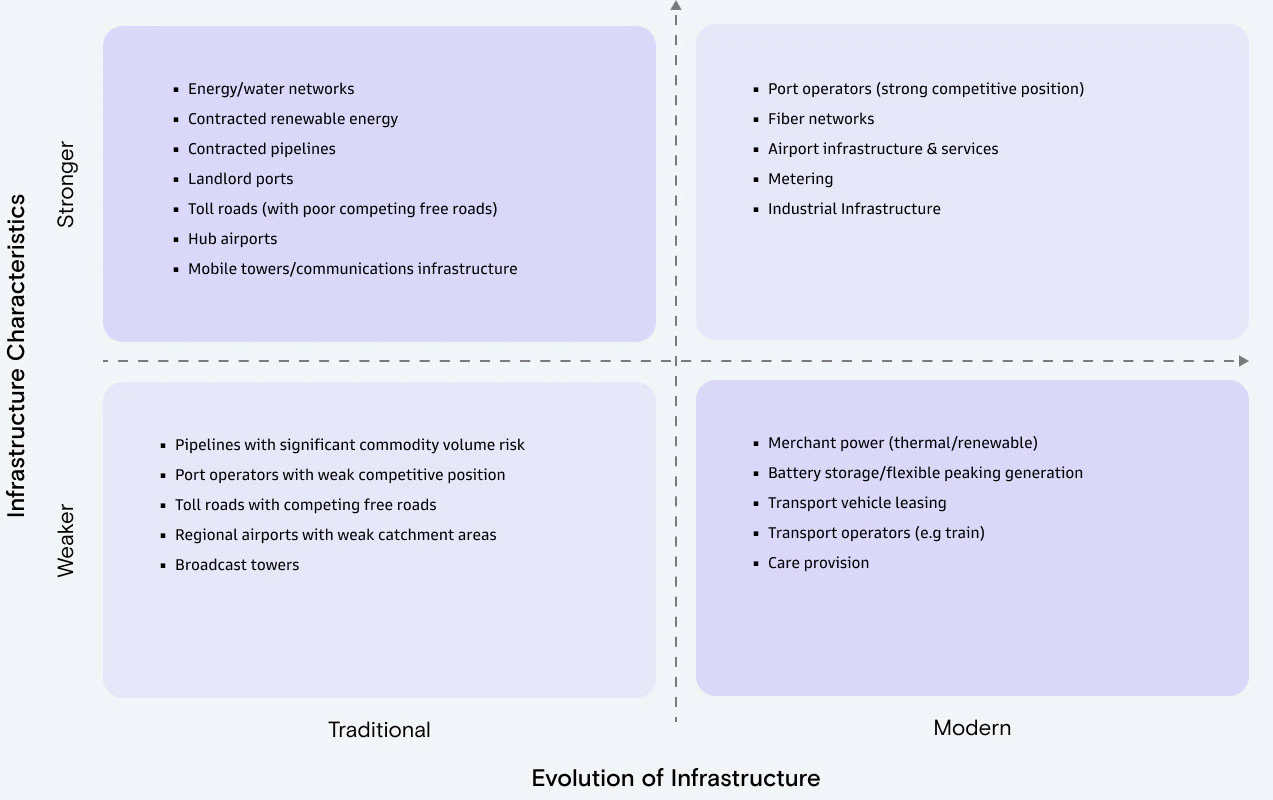

Infrastructure Opportunities Are Evolving

Historically infrastructure was narrowly defined as assets needed for the movement of people and physical goods, with focus on transportation and fossil fuels. This definition has evolved to today include more modern infrastructure, assets that incorporate the delivery of data and services, with a focus on digitization and energy transition. While the type of assets considered to be infrastructure has evolved, the key characteristics of infrastructure have remained more constant -- defensive and contractual cash flows, resiliency through economic cycles, incumbency advantages, and a critical role in society.

As of March, 2023. This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Furtrongroup Investment and is not financial research nor a product of Furtrongroup Investment Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Furtrongroup Investment Global Investment Research or other departments or divisions of Furtrongroup Investment and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Furtrongroup Investment has no obligation to provide any updates or changes.

Targeted Investments

Our experience across market cycles allows us to seek opportunities in the rapidly evolving infrastructure industry. We target essential infrastructure assets and companies with stable cash flow profiles through long-term contracts and high barriers to entry.

We emphasize value creation and enhanced returns through balanced investing across the capital stack and the asset life cycle, including development, construction and operations.

Infrastructure Opportunities Sectors

Sustainable Infrastructure

Climate Infrastructure

Value Proposition

Experience Across the Asset Life Cycle

Operational, construction, and development experience allow us to add-value and optimize asset performance

Robust Origination Capabilities

Technical experience and industry relationships spanning more than two decades create opportunities for proprietary deal flow

Flexible Capital Approach

We provide bespoke solutions ranging from structured debt to equity investments across assets and platforms